Fashion is my way of escaping and diving into a world where the biggest hang-up is whether or not it’s okay to wear white pants after Labor Day (it’s totally fine by the way). I follow all of the big name designers and what they are creating. I also love keeping up my favorite fashion bloggers (Rachel Parcell, Lindsi Lane …

Answers to Your Most Frequently Asked Mortgage Questions

Looking to get a mortgage? You probably have a lot of questions, and that’s okay! There are so many different things to know about home loans. Whether it’s mortgage insurance, different loan types or the types of documents you need to get pre-approved, there’s a lot that goes into the mortgage process. Pelican Mortgage Originators Chris Neal, NMLS ID #1385376, …

What to Expect When Applying for an Auto Loan

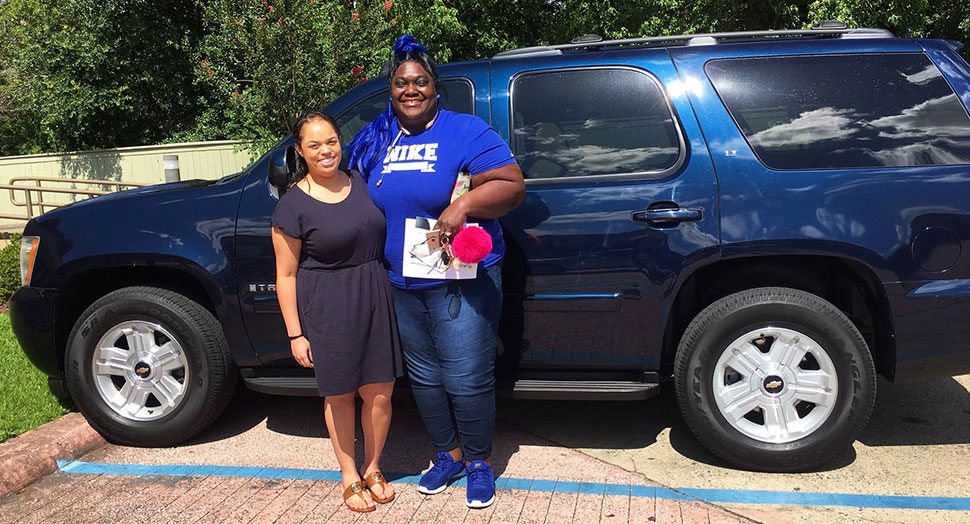

Buying a vehicle is a pretty big deal, and it’s definitely not something you should take lightly. While it might seem fun to go buy a new car or truck on a whim, it could end up costing you in the long run. When you determine if you can afford a new car, you should go in armed with the …

Home Buying Process Recap: Your Questions, Answered

We invited the Zachary and Jackson communities to join us in February 2018 for a Financial Wellness Workshop that was focused on the home buying process. This workshop was totally free and open to the public! The Panel A panel composed of Pelican’s Nationally Certified Credit Counselor Kimberly Gaines, Greater Baton Rouge Keller Williams Realtor Jan Johnson and Pelican’s Mortgage …

Tips for the Trade-In: Making the Most of Your Used Vehicle

When it comes to buying a vehicle when you already own one, there are always decisions to be made regarding your current vehicle. Our partners at Enterprise Car Sales helped us answer some frequently asked questions by those looking to trade in their vehicle: Can I trade in a vehicle if I still owe on it? The short answer: yes, …

Here’s Where You Can Get Income-Based Assistance in Louisiana

“I never thought it would happen to me.” I can still hear the voice of the older man at one of our local fast food restaurants telling my wife and I this when we were there grabbing something to eat. He told us how he always had money, but life happened and now he doesn’t have anything. He didn’t ask …