Student debt is a really touchy subject—even for me. I remember my first year of college. Fresh out of high school, I had a small part-time job at a pizza place, and had these really big ideas for changing the world and being a billionaire thanks to my college education! I thought was going to ace every test and, most importantly, I was going to get out of school completely debt free!

Well, one of those big ideas didn’t happen. I graduated, landed a job and could still become a billionaire. However, I could have used what I know now to get out of college with less debt. Student debt is actually so bad that right now 3 out of 4 students graduate with debt. Students have to learn how to save money in college or else the debt keeps piling up! How and why should you be planning for student debt, and what changes can you make right now to make your future financial goals possible?

Why should you plan for student debt?

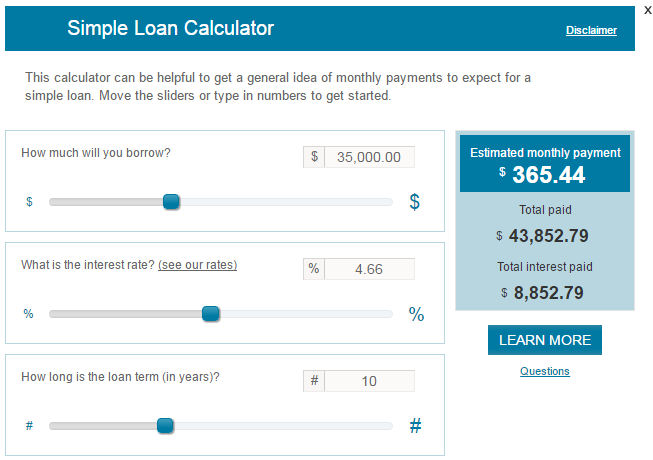

Many people get out of college without thinking about their future loan repayments. The average debt for college students is almost $35,000 per borrower, which is insane! That comes to about $365 per month, which is a huge chunk of your paycheck! Without the proper amount of planning, you could be in for a struggle during the 10 or more years that you’ll be paying these loans back.

You might think that if times get tough you can just declare bankruptcy and everything will be good, right? Well, it’s not that simple. Not only is bankruptcy bad for your credit score even if you could do it, declaring bankruptcy won’t clear out your student debt. It doesn’t matter if you have loans from a private financial institution or from the government, you’re stuck paying those until they’re completely gone.

Without proper planning, your student loan debt payments may end up limiting your ability to borrow money. That means it’ll take longer to get your dream home or that new set of wheels you’ve had your eye on. It’s not all bad news, though! You can plan for student debt to help alleviate or even completely remove the need for student loans!

How can you plan for student debt?

In the same way you make an investment in your house or a business, you are investing in yourself and your future with a college degree. These investments all require careful planning, like figuring out your monthly payments to see what you can afford, saving money to put toward the debt and trying to alleviate as much of the debt as possible.

It’s also a good idea to talk with your parents about what you’ll be responsible for paying. Deciding before-hand if your parents can help will give you a better idea of your future financial situation and will let you know what you’re responsible for paying. This way, when it comes time for a new semester after summer’s over, you can be better prepared by using your savings from your summer job instead of having to take out a loan for that semester’s textbooks.

If you’re using student loans to pay your way through college, make sure you know how much that college education is going to cost you per month. Use a loan calculator to find out your future monthly payments:

That’s a pretty big monthly payment for your college education! Try to reduce that payment by getting yourself prepared for paying it off before, during and after college. Without preparing for this investment, you run a huge risk of spending lots of your future income on your education. Those large monthly payments might make you feel like you’re throwing money out of the window.

How can I reduce my student debt before college?

There are plenty of things you can do while you’re in high school to cut the cost of college education! Beyond simply saving money in your savings account, you can also:

- Apply for scholarships. This seems like a no-brainer, but many students don’t take the time to apply for college scholarships. You can find scholarships around almost every corner of the internet and at many businesses, including your local credit union. Louisiana has a non-profit resource for college planning that offers scholarships to help make college less of a financial burden.

- Ask for money for graduation. Instead of getting that new game console or phone you’ve been drooling over, ask your relatives for cash! They’ll probably be willing to give you more if you say it’s for your college tuition.

- Take college courses in high school. Many high schools offer Advanced Placement (AP) courses to students, which can give you college course credit without the cost of tuition! Taking these classes will definitely help cut out some of that student debt.

- Get a part-time job each summer. It might not be as fun as hanging out with your friends every day, but getting a part-time job can free up time in your future by cutting down how much you owe for college. Just make sure you’re actually saving the money you make.

How can I reduce my student debt while I’m in college?

You’re probably thinking that it isn’t easy to save money in college. You’ve got to work, attend classes that are all over the place during the week and try to find time to study and have a social life. Well, you can make some really smart decisions to help save money while you’re in college, like:

- Only take out loans for tuition. Pay your other fees and books out of pocket. The extra hundreds each semester might seem like an inconvenience, but it’s actually saving you money. Those fees and textbooks add up quickly, easily adding thousands to your future student debt payments.

- Get a part-time job on campus. Why drive to a job and waste money on gas when you can work on campus? You can use the money you make to help pay down some of the student debt you’re racking up.

- Use your meal plan. You’re probably already paying for your meal plan at college, but are you really using it? Instead of paying for food every day, head over to the dining hall for your meals. This will end up saving you hundreds or even thousands over the course of your college career.

- Stay in (or work) on the weekends. Instead of heading out with your friends every weekend, stay in or get on the weekend shift at work. By not going out you’re already saving money you would have spent with your friends, and working the weekend gives you extra money on top of that!

How can I reduce my student debt after college?

Do you really need to get a brand new car right after college, or can you keep your current car? Can you even afford a new car? There are lots of decisions you’ll probably want to jump into right after college, but it might be smarter to wait a while before making those big purchases. It can be aggravating to hold off, but you’ll be in a much better financial position because of it. Besides holding off on purchases, you can also:

- Get a roommate to split living expenses. Are you ready to get out of your parents’ house but really want to save on living expenses? Sharing an apartment or house with a roommate can help cut out hundreds of dollars per month, which can go towards that huge monthly student loan payment.

- Focus on grocery shopping instead of take-out. It normally costs much less to cook a meal from scratch than get take-out. (You can end up adding lots of extra money to your monthly loan payments or to your savings account by making this easy money-saving change to your monthly budget!)

- Make your coffee at home. $4 lattes really start to add up after a while. If you make your coffee at home, you could end up saving over $1,000 each year!

Sure, it’s not an ideal thing to think about, especially before you even enter college, but it’s extremely important to plan for student debt. With the rising cost of tuition and the ease of access to credit, it’s not something that you should “get around to” or “think about in the future.” The last thing you want is to be stuck paying off a large amount of student debt and not be able to live your life.

Students, what have you done to plan for college debt?

Parents, have you talked to your kids about the costs of college and what they can do to prepare?

Lover of writing, learning and teaching others about new things. Proud foodie. Sometimes I mix all of these subjects together.