There aren’t many things more challenging than the passing of a loved one. It’s emotionally difficult, and complications may arise while handling the person’s finances. You might not know what steps to take after receiving the heartbreaking news.

It may be difficult to get through day-to-day tasks, while trying to make financial decisions. Pelican’s committed to being your financial family for life, and we understand that managing your loved one’s finances while mourning is daunting. We want to provide you with tips to help you through this difficult time.

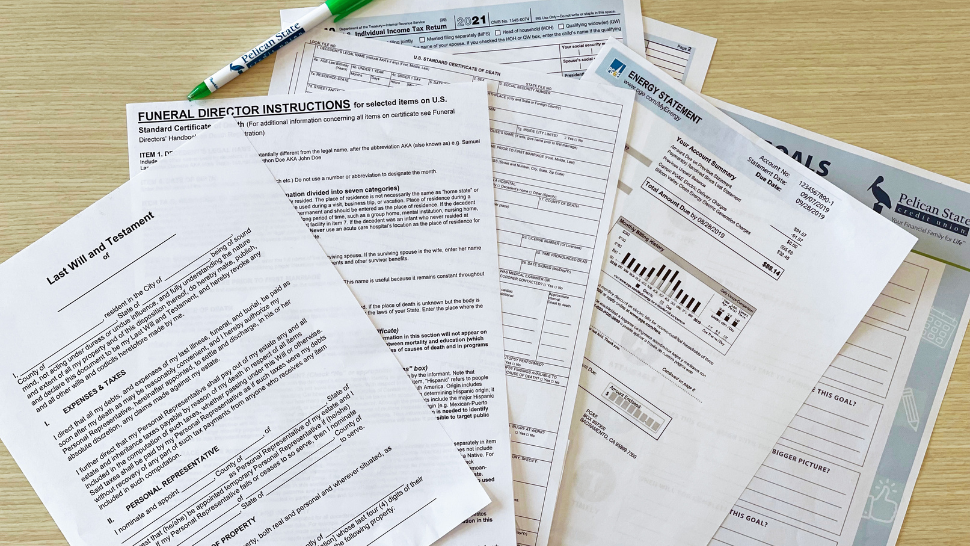

It’s always best to make certain end-of-life financial decisions before a loved one passes. Wills should be kept up to date, as should Power of Attorney documents, Trusts, and Advance Directives.

Review the Will and its Executor

If you or your loved one don’t have a will, you can create one for free here. First, determine who is in charge of handling the affairs of the deceased.

If a will or Trust exists, the document will name the Executor. Executors are usually a spouse or a person trusted by the family to carry out certain business. If no will exists, appoint someone with the skills necessary to take the lead in administering the estate. That person will need to get court documents and take care of the residence until it’s sold.

The administration of an estate can be complex and overwhelming. You can receive additional support on this task by speaking to an Estate Planning Lawyer. There will be a cost associated, but it can be worth it if you or your family are unable to take on this job.

Determine Funeral Arrangements

You may find that your loved one already made financial arrangements with a funeral home. Contact the funeral home, make the burial arrangements, and determine if there is a prepaid burial plan in place.

If not, you’ll need to determine if there is money available from the deceased. Research funeral prices so you understand the expected cost.

Collect Necessary Documents and Notify Institutions

First, obtain multiple copies of your loved one’s death certificate. Institutions will request copies of the death certificate as evidence of the person’s passing. As soon as possible, send a copy of the death certificate to the Social Security Administration.

Notifying the Social Security Administration that a loved one has passed allows them to mark the person as deceased and to end any future payments going to them.

If Social Security benefits continue to be paid, returning the money can be time-consuming. Promptly reporting a death will also allow you to begin the process of applying for survivor’s benefits.

Collect as much of this paperwork as you can, including documents associated with estate planning, credit card statements, bank statements, life insurance policies, car titles, and any similar items you can think of.

Hopefully, your loved one had some sort of filing system for bills, tax receipts, and other financial information. Expect to present the death certificate to banks, phone service providers, and many other institutions. A few other assets you might inquire about include deeds and titles, employer benefits, and retirement assets.

Contact Utility, Insurance, and Financial Institutions

Executors determine which bills need to be paid including utilities, phone, cable, etc. You’ll want to stop automatic payments and monitor credit cards.

Depending on the person’s level of organization, you’ll need to identify where their money is and if anything is being paid automatically. Old tax returns can identify income sources.

Finding where money is stored can be a challenge because having multiple bank accounts, investment accounts, pension providers, loans, credit cards, and insurance companies is not unusual.

Policy payouts can fund final expenses so contacting the life insurance company first is ideal.

Criminals constantly look for information from deceased individuals. So, notify credit reporting companies so they can add a deceased indicator to the credit report. Don’t forget to review your loved one’s credit report to determine if there are any major errors to cases of fraud.

Prepare Final Tax Filings

Dealing with taxes can be very challenging following the death of a loved one. Inheritance taxes are a possibility. If they worked in the year of their death, they may owe taxes or at least have required tax forms you’ll need access to. Doing so earlier rather than later in the process may make it easier to understand what in the estate is truly available to the heirs. An accountant, tax attorney, or tax preparer can help with this.

Determine Your Own Financial Obligations

It’s important to not neglect to pay your own bills during this time. Not paying your bills can result in late fees and have a negative impact on your credit score! Establish a schedule to pay your bills on time and hold yourself accountable.

Set SMART Goals

SMART goals are:

- Specific

- Measurable

- Attainable

- Realistic

- Time-Based

The experience of losing a loved one most likely changed your financial priorities. Decide what you would like to do with your money and put a plan in place to make your financial goals a reality.

Re-Evaluate Your Situation and Create a New Spending Plan.

Losing a loved one can mean a change in income and expenses. You will need to adjust your spending accordingly. Explain to your children the necessary adjustments so they understand when cutbacks are made. It’s important to re-establish a safety net by continuing or starting to contribute to an emergency and retirement fund.

Attending to the affairs of a deceased loved one can be emotionally exhausting and time-consuming. The best course of action is to identify the most important steps in the process and move forward from there. Take time to review wills, estate plans, and life insurance policies.

Don’t forget to seek out help and use the resources available to you. Make sure you take some time to relax, reflect, and take care of yourself during this time as well!

When you’re ready, there are a few steps you can take to move forward financially! Pelican’s Nationally Certified Credit Counselors are here to help guide you during this process.

My name is Todd Kidder, and I’m a Nationally Certified Credit Counselor. I have over 30 years of credit union, mortgage lending, and consumer lending experience. I have dedicated my career to helping clients improve their financial situation and provide helpful education along the way. Beyond that, I’m very passionate about youth financial education. I work with public schools in St. Landry Parish, teaching both junior high and high schools students about responsible financing.