So, you’re a young adult looking toward one of the most crucial moments of your life—your education after high school—and you’re wondering how best to prepare your finances for college.

Your parents believe that sending you to college is an investment in your future, and you strongly agree. They may have some money saved, but you’ve also decided to start looking into ways to ease the financial load.

Here are some tips we recommend to help you start saving:

Compare Colleges

When planning for a four-year university, it’s helpful to research a few components like in-state or out-of-state schools, private or public, and living on campus or off.

These factors determine how much it will cost to attend your chosen institution.

In-state and public universities tend to cost less than out-of-state or private universities. Out-of-state students typically pay two to three times more in tuition than in-state students.

Furthermore, tuition at a private college can be as much as 350% more expensive than tuition at a public university.

Start Budgeting

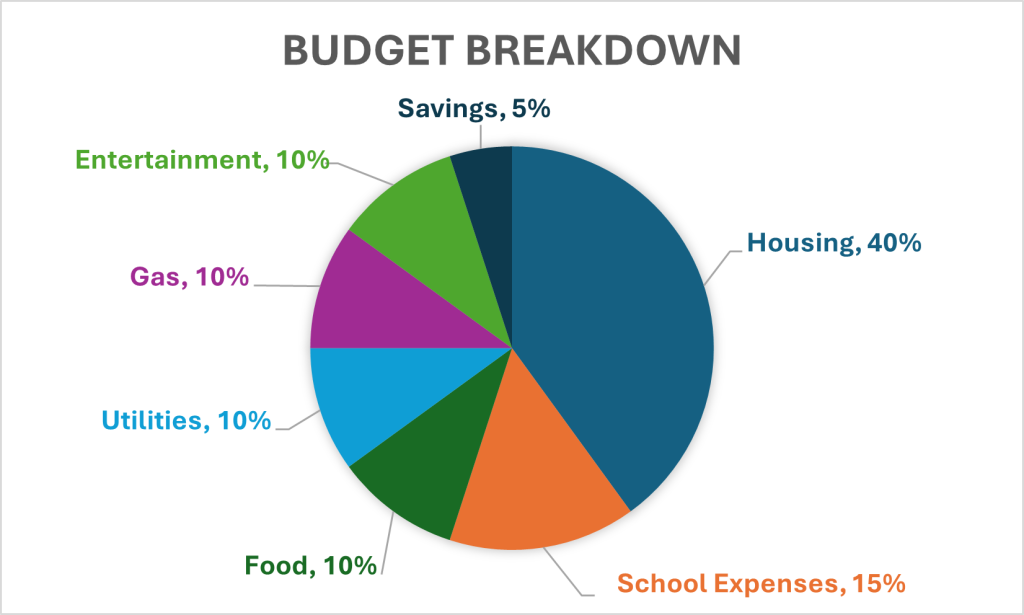

Budget Breakdown Chart

While you decide which school is best for you, start working on a budget. A budget will help you manage your finances while in school.

You can use a spreadsheet or a budgeting app to create a plan.

Determine how much of your income will go toward housing, food, transportation, books, entertainment, and savings, and log it on your budget sheet. Be honest about your spending limits and stick to them as much as possible.

Here is an example budget for a student who lives off-campus and earns $1,500 monthly. The budget breaks down how much money the student should spend for each monthly expense.

If you need help budgeting, you can schedule a no-cost meeting with one of our credit counselors.

Research Financial Aid/Scholarships

One of the most important things you can do while preparing for college is to research and apply for scholarships, grants, and other forms of financial aid.

Doing so can largely offset the cost of college and save you thousands of dollars in the long run!

The federal government provides various forms of financial aid, like Pell Grants, to low-income students, and you can find and apply for them by completing the Free Application for Federal Student Aid (FAFSA ®).

You can find an abundance of scholarships through the Internet, colleges, businesses, and community organizations tailored to many different academic achievements, talents, backgrounds, and affiliations. Financial institutions like Pelican State CU also offer scholarships as a membership benefit.

Make sure to research what kind of assistance your state gives to college students. Louisiana offers a non-profit college planning resource that helps make college less of a financial burden.

Consider Your Credit Options

The mention of student loans can cause eye rolls and groans, but they are an option to consider

when planning for college.

Before applying for student loans, consider the differences between federal and private loans. Federal student loans usually offer benefits that private student loans don’t, like income-driven repayment plans, lower and fixed interest rates, and tax deductions.

Join Work-Study Programs/Work Part-Time

Finally, our last tip is to consider joining a work-study program or working part-time.

Work-study programs are federally funded initiatives that offer students part-time employment opportunities. The programs have flexible schedules that accommodate students’ school commitments, making them a reasonable option for those with heavy school loads.

The programs are also great for developing time management skills, relevant work experience, networking opportunities, and more. The caveat is that they’re considered financial aid, and you must qualify for them through FASFA.

On the other hand, a traditional part-time job also allows you to earn money to cover school expenses. Jobs in the service industry typically offer more flexible schedules, allowing you to work around your school commitments.

Properly preparing your finances for college will set you up for financial success for the next four years and beyond. Understanding costs, budgeting, and exploring your options will allow you to enjoy the college experience without the added stress of figuring out how to cover your expenses.

Do you have more questions about preparing your finances for college? Let us know in the comments below!

Once a Pelican State CU member, always a member—through life’s milestones, we’ll always be there to help you with your financial needs. Your Financial Family for Life. Give us a call at 800-351-4877.